Scope Markets Minimum Deposit

Minimum Deposit Requirements Overview

| Account Type | Minimum Deposit | Currency Options |

| One Account | $50 | USD, EUR, GBP, AED |

| Islamic Account | $50 | USD, EUR, GBP, AED |

| Scope Invest | $50 | USD, EUR, GBP, AED |

| Elite Account | $20,000 | USD, EUR, GBP, AED |

Payment Methods

Our deposit system supports various payment options for account funding. Each method maintains specific processing timeframes and security protocols. The selection of payment methods ensures convenient account funding across different regions.

Available deposit methods include:

- International bank transfers

- Credit/debit cards

- Electronic payment systems

- Local payment solutions

- Mobile payment options

These methods undergo regular security verification for transaction safety.

Currency Options

Account funding accepts multiple currency options for client convenience. Currency conversion occurs at current market rates when necessary. The base currency selection remains fixed after account creation.

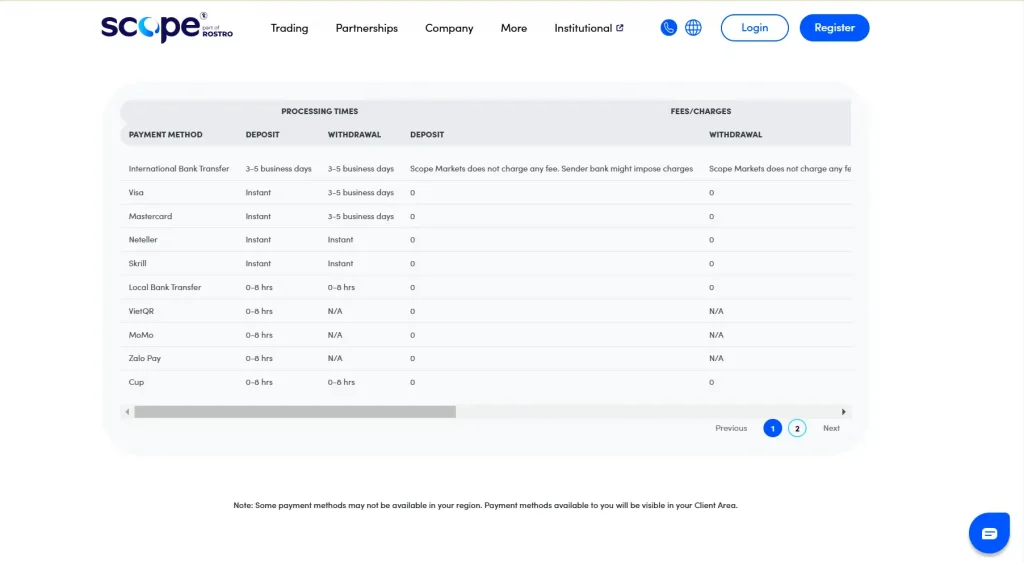

Processing Times

Different payment methods maintain varying processing schedules:

- Card payments: Instant

- Electronic transfers: 0-24 hours

- Bank transfers: 3-5 business days

- Local payments: 0-24 hours

- Mobile payments: Instant

Standard processing times may vary based on verification requirements.

Verification Requirements

Account funding requires completion of verification procedures. Documentation requirements vary based on deposit amount and method. Verification ensures compliance with regulatory standards and security protocols.

Deposit Limits

Transaction limits apply to different payment methods and account types. These limits ensure operational security and regulatory compliance. Regular review of limits occurs based on account status and trading history.

Maximum Deposit Limits

- Bank transfers: Unlimited

- Card payments: $5,000 per transaction

- Electronic payments: $10,000 per transaction

- Local transfers: Country-specific limits

- Mobile payments: Method-specific limits

Account Currency Selection

The initial account currency selection affects future transactions. Currency changes require administrative procedures after account creation. Consider trading preferences when selecting account currency.

Transaction Fees

Deposit processing may include specific fee structures. Fee amounts vary based on payment method and transaction size. Understanding fee structures assists in cost-effective account funding.

Fee Structure Overview

- Bank transfers: Bank-specific fees

- Card payments: No additional fees

- Electronic payments: Provider fees may apply

- Local transfers: Method-specific fees

- Mobile payments: Provider-specific fees

Corporate Account Requirements

Corporate accounts maintain separate minimum deposit requirements. Additional documentation applies for corporate account verification. Processing procedures follow specific corporate protocols.

Joint Account Deposits

Joint account funding requires authorization from account holders. Specific verification procedures apply to joint account transactions. Documentation requirements ensure proper authorization verification.

Account Maintenance Requirements

| Maintenance Type | Requirement | Notification |

| Standard Balance | $50 | Email Alert |

| Margin Call | 50% | Platform Alert |

| Stop Out | 20% | Immediate Notice |

| Elite Status | $20,000 | Regular Update |

International Transfer Procedures

International transfers follow specific routing procedures for different regions. Banking relationships facilitate efficient international processing. Documentation requirements vary by jurisdiction and transfer amount.

Required Documentation

International transfers require specific documentation:

- Proof of funds origin

- Transfer purpose declaration

- Account holder verification

- Bank confirmation details

- Regulatory compliance forms

Complete documentation ensures efficient processing.

Security Protocols

Transaction security measures protect client funds during processing. Multiple verification layers ensure secure fund transfers. Regular security updates maintain protection standards.

Security measures include:

- SSL encryption

- Two-factor authentication

- Transaction monitoring

- Fraud prevention systems

- Regular security audits

These protocols maintain transaction integrity.

Deposit Processing Steps

Account funding follows systematic processing procedures. Each step ensures proper transaction verification and processing. Completion notifications confirm successful deposits.

Frequently Asked Questions

Deposits below minimum requirements return to the originating account. Transaction fees may apply for returned deposits.

Standard verification requires 24-48 hours following document submission. Additional verification may apply for specific payment methods.

Additional deposit methods require separate verification procedures. New payment methods undergo security verification before activation.