Scope Markets Account Types

Trading Account Overview

| Account Type | Min Deposit | Spreads From | Commission |

| One Account | $50 | 0.9 pips | $5 |

| Islamic Account | $50 | 0.9 pips | $5 |

| Scope Invest | $50 | 0.1 pips | $0 |

| Elite Account | $20,000 | 0.0 pips | $3.50 |

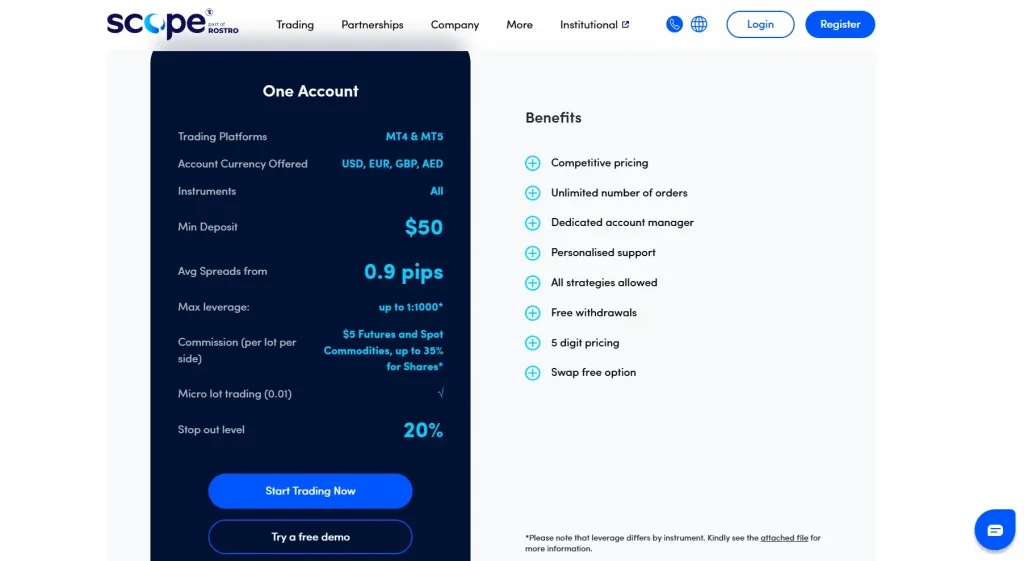

Standard One Account Features

The One Account represents our primary trading account option. This account type provides access to multiple trading instruments and platforms. Standard trading conditions apply to all operations.

Trading Specifications

Primary account features include:

- MetaTrader 4/5 platforms

- Multiple instrument access

- Standard leverage options

- Regular market execution

- Basic support services

These features support standard trading operations.

Islamic Account Structure

Islamic accounts maintain Shariah-compliant trading conditions. Swap-free trading applies to specific instruments. Special administrative fees may apply for extended positions.

Compliance Features

Islamic account requirements include:

- Swap-free trading

- Position time limits

- Administrative fee structure

- Instrument restrictions

- Special execution rules

Compliance monitoring ensures proper account operation.

Scope Invest Account Details

The Scope Invest account focuses on specific investment instruments. This account type maintains particular trading conditions and instrument access. Platform selection remains limited to MetaTrader 5.

Elite Account Specifications

Elite accounts provide enhanced trading conditions for qualified clients. Higher deposit requirements apply to account activation. Special services accompany account status.

Elite Benefits

Status advantages include:

- Reduced spreads

- Lower commissions

- Priority support

- Special analysis access

- Additional services

Regular review maintains benefit structure.

Account Currency Options

Multiple currency options support various trading preferences. Currency selection affects transaction processing. Conversion rates apply to specific operations.

Platform Availability

Different account types maintain specific platform access. Platform selection affects available features. Regular updates maintain system functionality.

Platform Options

Available platforms include:

- MetaTrader 4 terminal

- MetaTrader 5 terminal

- Mobile applications

- Web trading access

- Additional tools

Platform access varies by account type.

Trading Instrument Access

Account types determine available trading instruments. Market access varies by account category. Instrument selection affects trading conditions.

Leverage Options

| Instrument Type | Maximum Leverage |

| Forex Majors | 1:1000 |

| Indices | 1:500 |

| Commodities | 1:500 |

| Stocks | 1:10 |

Commission Structure

Different commission rates apply to various account types within our service framework. Transaction costs vary by instrument and volume, affecting overall trading expenses. Regular review maintains competitive pricing across all account categories. The commission system follows structured calculation methods for different trading scenarios.

Commission rates reflect several operational factors:

- Account type specifications

- Trading instrument selection

- Volume tier requirements

- Market condition impacts

- Transaction frequency levels

These elements determine final transaction costs for each operation. Regular assessment ensures commission structure alignment with market standards while maintaining operational efficiency. The systematic approach supports transparent cost calculation and predictable trading expenses.

Support Services

Support service levels vary by account category, providing appropriate assistance for different trading requirements. Response priorities depend on account status, ensuring efficient resource allocation. Multiple communication channels maintain service access across various time zones and regions. Our support infrastructure maintains specific response protocols for different inquiry categories.

Support channels include comprehensive options:

- Direct telephone contact

- Email communication systems

- Live chat functionality

- Personal account managers

- Emergency support lines

Each support level maintains specific response timeframes and service protocols. Regular training ensures support staff maintains current knowledge of all account features and requirements. The systematic approach to support services ensures consistent assistance quality while addressing specific account holder needs. Client feedback contributes to continuous service improvement and protocol refinement.

| Support Level | Response Time | Available Channels |

| Standard | 24 hours | Email, Chat |

| Premium | 12 hours | Email, Chat, Phone |

| Elite | 1 hour | All + Personal Manager |

| VIP | Immediate | Direct Access |

These structured support systems maintain operational efficiency while ensuring appropriate assistance for different account categories. Regular review processes identify improvement opportunities and maintain service quality standards across all support levels.

Account Maintenance

Regular maintenance requirements apply to all account types. Balance requirements vary by category. Status monitoring ensures compliance with account standards.

Frequently Asked Questions

Account selection determines spread levels, commission rates, and available features. Trading conditions vary according to account specifications.

Account upgrades require meeting higher category requirements. Upgrade procedures maintain specific verification protocols.

Standard verification applies to all accounts. Additional documentation may be required for specific account categories.